Property Tax Abatement Program

Pursuant to City code Sec. 44-71, the Property Tax Abatement Program encourages investment in construction, redevelopment, renovation in multi-family, mixed-use, and commercial properties. This incentive encourages the construction of new facilities and the rehabilitation of existing facilities which generates new permitting income and new wage taxes, as well as, the full value of property taxes when the abatement period expires.

- A 10-year abatement of City Real Estate Taxes attributable to qualified improvements for any market-rate multi-family residential or market-rate mixed-use property located in designated areas (see code). The abatement is applied only to the incremental increase in the building assessment resulting from the project. During years 1-5, 100% of the incremental assessment is abated. Throughout years 6-10, the incremental assessment value is phased in 20% per year. This is roughly equivalent to a 7.5 year 100% abatement on the difference in the building assessment before and after the project.

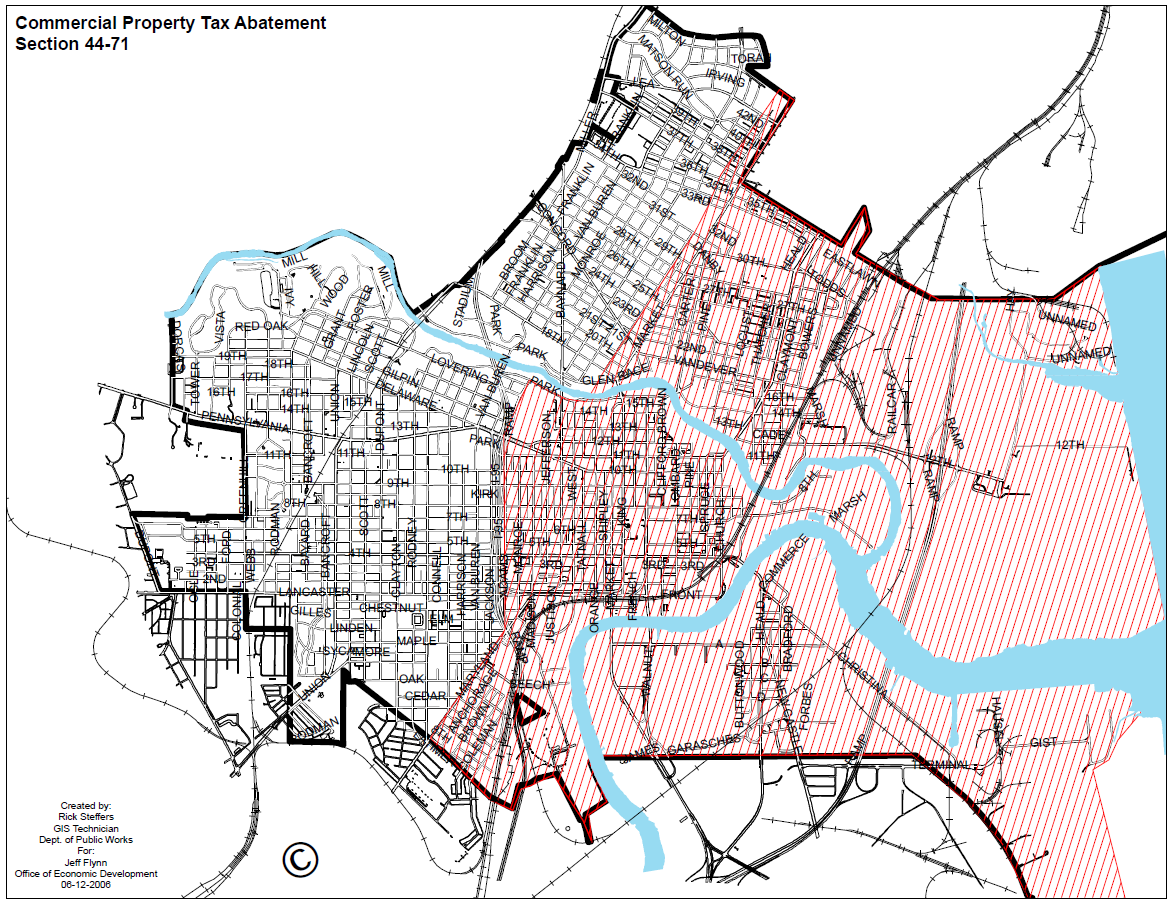

- A 5-year abatement of City Real Estate Taxes attributable to qualified improvements for any commercial property located in the designated areas of Sec. 44-71(c).

.png)

Sec. 44-71. - Real estate tax exemption program.

(a) Definitions. The following words, terms and phrases, when used in this section shall have the meanings ascribed to them in this section, except where the context clearly indicates a different meaning:

(1) Commercial property means a property maintained for the purpose of operating a for-profit business. For the purposes of this section, a residential property held for investment purposes will not be considered a commercial property and will be subject to the provisions of this section regarding residential and mixed-use properties.

(2) Market-rate means that not more than 25 percent of the total residential units are rent restricted.

(3) Mixed-use property means a property on which there is a building containing at least two above-ground stories in which:

a. Fifty percent of the first-floor space must be dedicated to retail uses;

b. No portion of the building is being used as a taproom or for the sale of packaged alcohol goods; and

c. The upper floors shall contain or include residential units, regardless of whether the uses are leased apartments or owner-occupied condominiums.

(4) Qualified improvement means an improvement to an existing structure or an improvement created by new construction that results in an increase in the assessment above the base assessment prior to the making of the improvement.

(b) Real estate tax exemption program for commercial, residential, and mixed-use properties. There is hereby authorized a real estate tax exemption program of 2019, which shall include real estate tax exemptions as an incentive to new construction and improvements to existing structures.

(c) Commercial properties. The real estate tax exemption program of 2019 shall be applicable to commercial properties as set forth below:

(1) There shall be a five-year abatement of 100 percent of city real estate taxes attributable to qualified improvements for any commercial property which:

a. Is located within the areas beginning at the intersection of the city line on the north, and the westerly side of Tatnall Street running south along the westerly side of Tatnall Street to the southerly bank of the Brandywine River, then west along the southerly bank of the Brandywine River to Adams Street, then south on Adams Street to its intersection with Delaware Avenue and Interstate 95, then south along Interstate 95 to the westerly side of Maryland Avenue, then south along the westerly side of Maryland Avenue to the city line on the south, east along the city line to its intersection with the Delaware River on the east, then north along the Delaware River to its intersection with the city line on the north, and west along the city line until its intersection with the westerly side of Tatnall Street;

b. Is located within any other areas that are included in an urban renewal area;

c. Is a commercially zoned property anywhere within the city that generates a minimum of 25 jobs that meet the definition of "qualifying activity" in 30 Del. C. § 2010(3); or

d. Is located within one continuous city block of the following neighborhood commercial corridors, inclusive of adjoining side streets: N. Market Street; Concord Avenue; Northeast Boulevard; Maryland Avenue; Lancaster Avenue; Fourth Street; Union Street; Church Street; S. Heald Street; and New Castle Avenue.

(d) Residential and mixed-use properties. The real estate tax exemption program of 2019 shall be applicable to residential and mixed-use properties as set forth below:

(1) There shall be a five-year abatement of 100 percent of city real estate taxes attributable to qualified improvements for any residential or mixed-use property which is located in those areas of the city identified as market types c through h in the 2015 market value analysis of the City of Wilmington performed by the Reinvestment Fund.

(2) There shall be a ten-year abatement of city real estate taxes attributable to qualified improvements for any market-rate multi-family residential or market-rate mixed-use property which is located:

a. Within the area bounded by beginning on the southerly side of the Brandywine River at its intersection with the westerly side of Washington Street, along the westerly side of Washington Street, then southward along Washington Street to its intersection with the Amtrak railroad line, then eastward along the Amtrak railroad line to its intersection with the easterly side of Walnut Street, and north along the easterly side of Walnut Street to the Brandywine River, and westerly along the Brandywine River to its intersection with the westerly side of Washington Street;

b. Within one continuous city block of the following neighborhood commercial corridors, inclusive of adjoining side streets: N. Market Street; Concord Avenue; Northeast Boulevard; Maryland Avenue; Lancaster Avenue; Fourth Street; Union Street; Church Street; S. Heald Street; and New Castle Avenue; or

c. Within the areas south and east of the Christina River with a W-4 zoning designation.

The ten-year tax abatement shall be calculated as follows: (i) the first five years of the abatement shall be for 100 percent of city real estate taxes attributable to qualified improvements and (ii) the second five years of the abatement shall be for city real estate taxes attributable to qualified improvements calculated on a graduated basis, in which the abatement shall be reduced by 20 percent in each year beginning at 100 percent in year seven until the abatement is fully eliminated at year 11.

(e) Conversion of commercial properties to market-rate multi-family residential or market-rate mixed-use properties. There shall be a five-year abatement of 100 percent of city real estate taxes attributable to qualified improvements or substantial improvements for any commercial property that is converted to a market-rate multi-family residential or market-rate mixed-use property within the geographical area bounded by beginning on the southerly side of the Brandywine River at its intersection with the westerly side of Washington Street, along the westerly side of Washington Street, then southward along Washington Street to its intersection with the Amtrak railroad line, then eastward along the Amtrak railroad line to its intersection with the easterly side of Walnut Street, and north along the easterly side of Walnut Street to the Brandywine River, and westerly along the Brandywine River to its intersection with the westerly side of Washington Street. For purposes of this subsection only, substantial improvement means an investment of greater than $50.00 per square foot, excluding acquisition costs, that does not result in an increase in the assessment above the base assessment prior to the making of the improvement. The investment shall be calculated as follows: the value of the building permit issued for the substantial improvement divided by the total square footage of the market-rate multi-family residential or market-rate mixed-use property.

(f) Zoning. The tax abatements in this section shall only apply when the qualified improvements or substantial improvements are for uses that are permitted as a matter of right for the property's zoning classification pursuant to chapter 48 of the city code.

(g) Effect of change in ownership. A tax abatement granted pursuant to this section resides with the property for the duration of the abatement regardless of ownership.

(h) Effect of reduction in assessed value of property by New Castle County. If any action by New Castle County regarding any commercial property, mixed-use property, or residential apartment building receiving a tax abatement pursuant to this section results in a reduction of the assessed value as compared to the assessed value at the time the abatement was granted, the existing tax abatement shall be revoked.

(i) Time limit for eligibility. The tax incentive program shall expire on June 30, 2030.

(j) Procedures.

(1) The finance department shall be authorized to promulgate such rules, regulations, procedures, and forms as it deems necessary to implement the real estate tax exemption program of 2019 and to administer the program as provided for tax incentive programs generally in this Code. The tax incentive program authorized by the provisions of this section shall be administered in accordance with the code's tax exemption provisions specifically regarding "effect of unpaid taxes, water and sewer charges and other fees or assessments," "effect of county reassessment," and "application for exemption from taxation of real property" in sections 44-53 through 44-56 of this chapter.

(2) Maps illustrating the areas included in the commercial, residential and mixed-use tax abatement programs of section 44-71 shall be maintained and kept on file in the city clerk's office and in the office of economic development.

(k) Extension of prior real estate tax exemption program. The city's prior real estate tax exemption program, which expired on June 30, 2018, shall apply from July 1, 2018 until the effective date of the real estate tax exemption program of 2019.

(Ord. No. 02-071(sub 1), § 2, 8-02-22; Ord. No. 04-099(sub 1), § 1, 12-9-04; Ord. No. 06-041(sub 2), § 2, 9-21-06; Ord. No. 10-029, § 1, 5-6-10; Ord. No. 14-020, § 1, 6-5-14; Ord. No. 19-025 , § 1, 7-11-19)

Category: Local